07/06/2024

Advisory fuel rate for company cars

HMRC has announced their new Advisory Fuel Rates (AFRs) for Employees and Directors using a company car.

Employees and Directors using a company car for private travel may be subject to a taxable fuel benefit if the company pays for their fuel. However, the taxable fuel benefit will not apply if all the private fuel is fully reimbursed by the Employee/Director using the Advisory Fuel Rates.

Alternatively, if the Employer’s policy is to not pay for any fuel for the company car, the Advisory Fuel Rates represent tax-free amounts that can be reimbursed to the Employee or Director for qualifying business journeys.

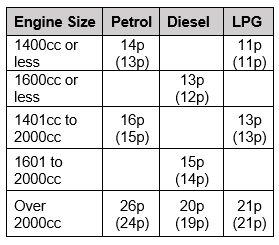

The rates from 1 June 2024 are summarised in the table below. Where there has been a change in the previous rate is shown in brackets.

You can also continue to use the previous rates for up to 1 month from the date the new rates apply.

Please note that for hybrid cars you must use the petrol or diesel rate and for fully electric vehicles the rate is 8p (9p) per mile.

Employees using their own car

Where Employees use their own car for business journeys, the tax-free reimbursement rate continues to be 45p per mile (plus 5p per passenger) for the first 10,000 business miles. This reduces to 25p per mile thereafter. The Employer can reclaim input VAT on such payments based on the figures in the above table. For example, if an Employee drives their own 2100cc LPG car for business journeys and is reimbursed 45p per mile, then 21p per mile is deemed to represent the cost of fuel. The Employer may claim 3.5p per mile (1/6) as input VAT, provided the Employee submits a fuel receipt to support the claim.

Please contact 023 8046 1232 or email Martin Back if you would like more information on the above.